Ohio’s minimum wage rules can feel dry on paper. And hence this blog is written to help you decode the different instances where the cash wage can differ according to employer, role, and region.

Ohio Minimum Wage

Today, for most non-tipped workers and for those who work for larger employers, the basic minimum wage for Ohio for 2025 is $10.70 per hour.

Those workers who earn through tips earn a cash wage of $5.35 per hour. It must be noted that the total pay, including tips, must still reach the minimum threshold of at least $10.70 per hour, whilst in case it falls short, the employer has to make up the difference and bridge the gap.

Smaller employers with annual gross receipts below $394,000 can pay the federal minimum wage of $7.25 per hour instead of $10.70. And that same federal rate also applies to workers under 16 years old.

Due to this unique situation, two workers in the same town can legally receive different minimum starting pay depending on the size of their employer and whether they earn tips or not.

Why Ohio Minimum Wage Matters

The Ohio minimum wage rate is adjusted regularly rather than frozen for years at the same number, as it is pegged to inflation.

This approach helps the wage floor move more in line with prices for basics like rent, groceries, and transport. This is even though it does not fully remove the squeeze from a rising cost of living, which is more or less seen as a given.

The Ohio minimum wage for workers sets the lowest legal hourly rate they should see on a paycheck. This is even seen for covered jobs, especially in sectors like retail, hospitality, and food service. For companies, it is a hard line they have to plan around when working out staffing levels, pricing, and scheduling. Why hardline, you ask? It is because failing to meet it can lead to complaints or penalties from state or federal agencies.

Ohio Regions And Cities

The uniform minimum wage rate applied to the entire state is one. There is no separate legal minimum for individual cities like Columbus, Cleveland, Cincinnati, Toledo, etc. The same $10.70 per hour rate applies statewide in 2025 for covered non‑tipped workers, unless a higher rate has been established in a particular workplace by specific local ordinance, union agreement, or contract.

Even with one legal bottom line, the actual pay can look very different on the ground as some employers choose to offer higher starting wages in an attempt to attract staff. This is particularly the case with bigger metro areas where competition for quality hires is stronger.

While the large chain retailers and hospitals in urban areas of the state sometimes, for the reasons mentioned above, advertise higher-than-minimum starting wages for specific positions, rural areas are likelier to hover closer to legal minimums.

Small And Large Employers

A clear distinction is made by Ohio law based on how much revenue a business brings in each year. At least $10.70 per hour is paid to non-tipped workers at standard minimum wage in 2025, by employers with lower annual gross receipts of $394,000.

The federal minimum wage of $7.25 per hour can legally be used instead by businesses under that revenue line, as long as they also follow Federal Labor Standards Act rules on things like overtime or record-keeping. The difference between the federal minimum of $7.25 and $10.70 can be significant for payroll plans of very small businesses.

This is why the Ohio Department of Commerce and the U.S. Department of Labor both stress checking which category a business falls into each year.

Ohio Minimum Wage By Job Type

Different types of jobs and pay structures can fall under different parts of the rules.

The major groups in Ohio are:

- Non-tipped hourly workers at covered larger employers are paid a minimum of $10.70 per hour in 2025.

- Workers who receive tips - such as many servers and bartenders - receive a minimum of $5.35 per hour in cash wages, the tips being expected to bring them up at least as high as $10.70 per hour in toto; if not, the employer must make up the difference.

- Workers under 16 and employees of very small employers under the $394,000 threshold are to get at least the federal rate of $7.25 per hour.

On top of that, certain public works and government‑funded construction projects in Ohio must follow “prevailing wage” rules. These rules have assigned minimum pay rates for particular trades that can be higher than the regular state minimum wage.

Some workers on federal contracts may also come under separate federal contractor minimum wage orders, which list higher hourly rates than the minimum wage in Ohio.

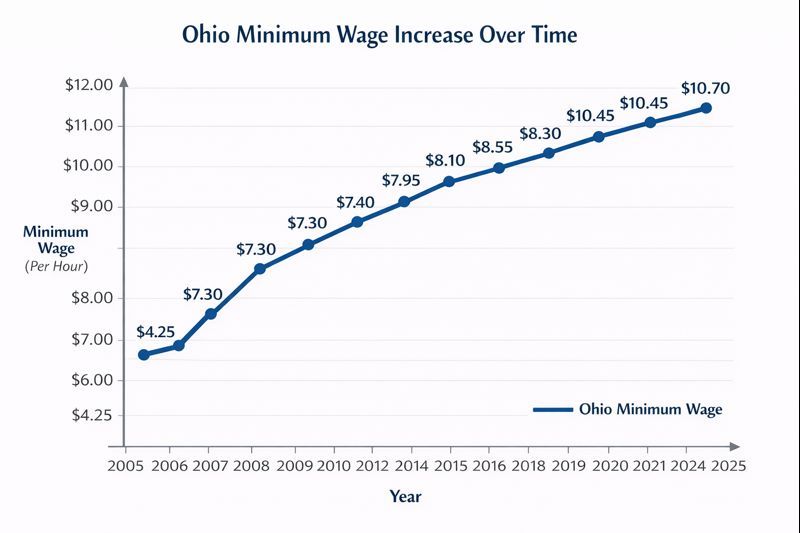

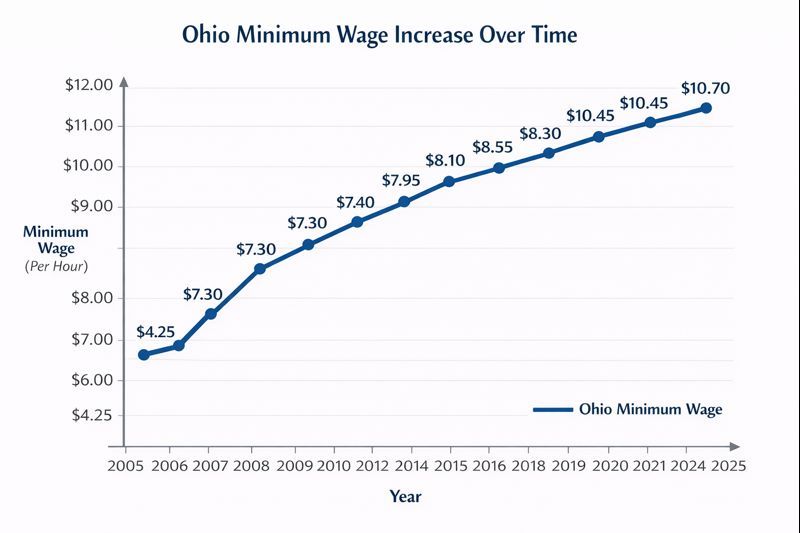

How the Minimum Wage in Ohio Has Changed

Over the last several years, Ohio’s minimum wage has risen step by step, partly because of the inflation‑linking mechanism built into state law. [1][6] The state’s recent figures for non‑tipped workers at standard employers show the trend clearly:

| Year | Ohio Minimum Wage (per hour) | Notes |

|---|---|---|

| 2025 | $10.70 | Effective January 1. (For businesses > $394K in receipts). |

| 2024 | $10.45 | |

| 2023 | $10.10 | |

| 2022 | $9.30 | |

| 2021 | $8.80 | |

| 2020 | $8.70 | |

| 2019 | $8.55 | |

| 2018 | $8.30 | |

| 2017 | $8.15 | |

| 2016 | $8.10 | |

| 2015 | $8.10 | |

| 2014 | $7.95 | |

| 2013 | $7.85 | |

| 2012 | $7.70 | |

| 2011 | $7.40 | |

| 2010 | $7.30 | |

| 2009 | $7.30 | |

| 2008 | $7.00 | |

| 2007 | $6.85 | First year constitutional amendment took effect (indexed to inflation). |

| 2006 | $4.25 | State rate was lower than the Federal rate of $5.15. |

| 2005 | $4.25 | State rate was lower than the Federal rate of $5.15. |

In the mid-2000s, Ohio voters had approved reforms to increase the minimum wage as detailed above. The future Ohio minimum wage was tied by these reforms to changes in inflation rather than leaving it to occasional one‑off legislative updates.

The Ohio Department of Commerce publishes an official minimum wage poster and an online notice every year; consequently, the U.S. Department of Labor also maintains a consolidated state minimum wage table. Both departments are useful to double‑check the current numbers.

FAQs

1. What is the Ohio minimum wage for 2025?

The FLSA Employer Posting requirement includes the following: For most non‑tipped workers at employers with annual gross receipts of $394,000 or more, the minimum wage is $10.70 per hour. For tipped workers at those employers, the cash wage is $5.35 per hour, but total pay with tips must reach at least $10.70 per hour.

2. Does every employer in Ohio have to pay $10.70 per hour?

No. Employers in that year grossing no more than $394,000 annually, and employees who are under age 16 may be paid at no less than the federal minimum wage of $7.25 per hour instead.

3. Can an Ohio city make a higher minimum wage?

Ohio has only one minimum wage rate at the state level, and according to state resources, one uniform figure exists, while union contracts, local government policies, or specific projects may place a higher wage in the workplace.

4. Where can workers and employers verify the latest official rate?

The U.S. Department of Labor’s state minimum wage pages are responsible for the current information available on minimum wage in Ohio. This can also be obtained from the Ohio Department of Commerce Wage & Hour Division, which posts yearly minimum wage charts and printable posters.